Dundee Capital Markets Vice President and Senior Mining Analyst David Talbot worked for nine years as a geologist in the gold exploration industry in northern Ontario with Placer Dome, Franco-Nevada and Newmont Capital. Talbot joined Dundee's research department in May 2003, and in summer 2007 took over the role of analyzing the fast-growing uranium sector. Talbot is a member of the Prospectors & Developers Association of Canada and the Society of Economic Geologists, and he graduated with distinction from the University of Western Ontario, with a bachelor's degree in geology with honors.

The Energy Report: David, the uranium spot price has recovered to a 52-week high of about $35 per pound ($35/lb) after nearly three months in the doldrums. What drove the rise?

David Talbot: This uranium price rally is due to a few temporary news items, and perhaps one real supply/demand story. The Cameco Corp. (CCO:TSX; CCJ:NYSE) strike was a driver, as it was headline news, but now the strike is over. It wouldn't have impacted the market anyway, unless it had lasted for several months, but investors did get excited.

There is risk with regard to Russia due to increasingly harsh sanctions, but this is simply a worry at this point. We have a hard time believing that Europe and the U.S. are going to cut off 24% and 18%, respectively, of their own nuclear fuel sources. If the cuts do happen, the impact might be huge, however.

Finally, ConverDyn Corp. (private), the U.S. uranium converter, is suing the U.S. Department of Energy to stop it from dumping stockpile supply into the spot market to the detriment of uranium companies and converters.

"Fission Uranium Corp. is a no-brainer; the company cannot miss."

But the spot market is tighter due to a decrease in spot supply. Paladin Energy Ltd.'s (PDN:TSX; PDN:ASX) Kayelekera Mine, which used to sell 3.3 million pounds (3.3 Mlb) of U3O8 in the spot annually, is now closed. Paladin sold a 25% interest in Langer Heinrich Mine to the Chinese. That 1.3 Mlb used to be sold in the spot, and now it's going directly to the China National Nuclear Corp. Uzbekistan has annual production of 6.2 Mlb of U3O8. I believe only 1 Mlb of that was contracted previously, and most of the rest had been sold into spot. Combined, that's about 10 Mlb removed from annual spot sales, not to mention lower spot sales from Uranium Energy Corp. (UEC:NYSE.MKT), Ur-Energy Inc. (URE:TSX; URG:NYSE.MKT) and other producers that have curtailed production at these prices. I think the longer prices stay down, the less incentive there is to develop projects or continue mining at some operations.

TER: The price is back up to where it was stalled for a number of months earlier. Do you think it's going to continue to rise?

DT: We're not confident that we are in a sustainable price rally. We might see a leveling off or rebalancing in the $30â€"35/lb range. We really don't expect the price to sink back down below $30/lb. Until we see meaningful supply cuts and Japanese restarts spurring uranium purchases, the market remains oversupplied, perhaps through 2017, by our estimates.

TER: The spread between spot and contract price is shrinking. What's your estimate for 2015 for both of those prices?

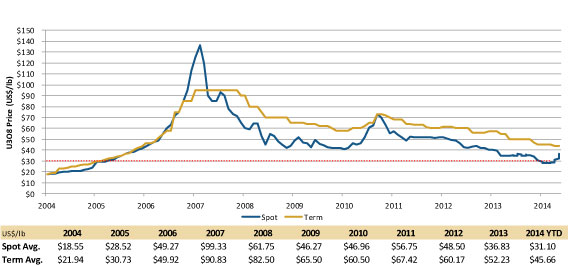

DT: The spread shrank as the spot price rose, and the term price remained stagnant over the same period. Historically, there was no spread between these two prices, but starting about 2005â€"2006, when investors started to buy spot uranium, we did see a separation. It's likely that utilities won't contract as much uranium with such a large spread, and that's why term volumes are down so much, in part.

Graph courtesy Dundee Capital Markets

Recently, the spread between spot and term dropped to about $7.50/lb. That's almost a three-year low. Over the past decade, the average has been about $10.50/lb. Our price forecast for 2015 is $40/lb for spot U3O8, and $58/lb for term U3O8. We expect to start seeing an influx of term contracting to cover future uranium requirements by the nuclear utilities, which is very important. Term contract volumes have only been 85 Mlb combined over the past two years, versus about 350 Mlb that has physically been used in the reactors. Term volumes have more than tripled over last year, but still, something has to give.

The Ux Consulting charts of uncovered uranium requirements at reactors show a steepening slope on the graph, suggesting that the urgency of procuring fuel is increasing. This happened in 2005â€"2007, when many utilities rushed to the market at the same time and prices rose dramatically. When the heavy contracting was done, the line on the chart flattened and prices fell. As we're seeing an increasingly steep uncovered requirement trend line again, we believe when contracting does begin, it will feed off itself, specifically for 2017 and beyond, and prices could take off.

TER: The term price on the charts that I've seen has fallen to $44/lb. If that continues, what would it mean for the economics of mining?

DT: It doesn't look good for the economics of mining. Broadly speaking, only about 100 Mlb of annual supply is economic at the $34/lb level. Considering corporate costs, debt and other reasonable returns on capital, that number would probably be lower. Very few operating companies can actually make profits, except perhaps ultralow-cost mines in Kazakhstan, and maybe some U.S. in-situ recovery mines (ISRs) as well. Most will rely on long-term contracts at higher prices to generate positive cash flow.

"Production at Ur-Energy Inc.'s Lost Creek has gone well in year one."

World averages for production costs are about $50/lb for open-pit mining, about $45/lb for underground mining, which tends to be higher grade, and $38/lb for low-cost ISR. We see potential for further shutdowns, like the Rossing uranium mine in Namibia (Rio Tinto), if prices persist at these levels. The lack of margin also eliminates much of the incentive for investors to finance projects.

TER: What is the progress on the restart of the Japanese nuclear power sector?

DT: Kyushu Electric Power Co. Inc.'s (9508:TKY) two Sendai reactors have been approved by Japan's Nuclear Regulatory Agency (NRA). On Sept. 10, the NRA said that the two reactors met safety requirements for restart. The reactors still have to pass operational safety checks and win the approval of local authorities. While there are hurdles, this is the closest we have been to restarts post-Fukushima, and many expect first restarts in Japan early next year.

We believe that 13 of the 19 Japanese reactors that have applied for restart have some degree of local support; those should be easier to get back online. Many investors are focused on the negative, but it's important to note that Japan represents only 10% of world demand for U3O8. Germany, the poster child of Western powers getting away from nuclear, would have been down to 2% of demand anyway by 2020, even before its decision to exit. The other 88% of the world still needs uranium to run its nuclear power plants, and the number of plants being built continues to rise.

Japan is still taking delivery of much of its contracted uranium. Although it is lending some, large inventories have been built up. I expect that the contracts will be renewed in some fashion. The Japanese are relationship-driven, and probably won't risk losing personal connections or access to product. Security of supply is important to the country.

People are interested in the long-term fundamentals of the industry. Almost everybody believes that demand for energy will continue to grow. Clean energy is preferred, as the effects of global warming become more prominent. Even oil-rich nations, such as United Arab Emirates and Saudi Arabia, are diversifying into nuclear. We expect several other nations to do the same as the need for low-cost, baseload energy increasesâ€"especially as electric vehicles begin to take hold. Initial capital for nuclear isn't cheap, but solar, wind and other intermittent alternatives simply cannot provide baseload stability or cover large energy requirements. There should be a mix, and nuclear should be in that mix.

TER: What developments should investors be concerned about in the uranium space?

DT: People should be worried about underfeeding. For those who aren't familiar with underfeeding, it's a matter of keeping the centrifuge machines turning and putting more work into enriching uranium. The lower enrichment prices get with this technology, the less natural uranium the utilities require, which is not good for the producers. The utilities get their desired amount of enriched uranium, and what follows can be sold by the enricher without losing any additional U3O8.

"Until we see meaningful supply cuts and Japanese restarts spurring uranium purchases, the market remains oversupplied, perhaps through 2017."

With the U.S.â€"Russian Highly Enriched Uranium Agreement (HEU/Megatons to Megawatts Program) gone, enrichers have available capacity and have been enriching their own supplies. Just as worrisome, HEU supplies were sold into long-term contracts, but underfeeding supplies are being partially dumped into the spot market.

Underfeeding has always been around, but it appears that underfeeding supplies have increased by about 50% this year, to an estimated 5â€"15 Mlb worldwide. This underfeeding is the main reason why the HEU agreement end hasn't had the market impact that many thought it would.

TER: What would you expect the effect to be on spot and term prices if underfeeding continues?

DT: It's certainly going to slow down any rally in the uranium sector. The problem is, as long as uranium prices are low, enrichers are going to have excess capacity. As long as they have excess capacity, they're going to continue to do enrichment work and provide more of a product that's coming into the market at low prices. It's an ongoing issue. Do I see that changing in the short term? Not necessarily. Before we see a fix in the underfeeding issue, I believe that the utilities need to get back to purchasing uranium, thereby using up much of this available enrichment capacity.

TER: What Canadian companies do you find interesting?

DT: Cameco is a top-tier exploration-producer. Essentially, it's the only blue-chip stock in the uranium sector. We currently recommend Cameco with a Buy rating, high-risk. We have a $23.50/share target price on the stock, although Cameco's share price has come off recently.

We believe that if uranium turns, Cameco is the go-to name for big money in the sector. The company has a large portfolio of high-grade, long-life, world-class and relatively low-cost operations. This top defensive play realizes uranium prices that are about 33% higher than spot prices at current levels. Cigar Lake is now operational, and we are waiting for it to ramp up, and risk does exist with the ongoing Canada Revenue Agency litigation, but the company's low sensitivity to uranium price is important at these low prices.

Second, we like Denison Mines Corp. (DML:TSX; DNN:NYSE.MKT), a highly liquid, well-capitalized, well-respected exploration and development play. We recommend Denison with a Buy rating, high-risk, with a $2.10/share target price.

"The longer prices stay down, the less incentive there is to develop projects or continue mining at some operations."

Denison hosts about 174 Mlb of resources in total. It has significant high-grade U3O8 located predominately in the Athabasca Basin. The Phoenix project, for example, hosts 71 Mlb, and at 18.5% U3O8, is the highest-grade uranium resource anywhere in the world. Gryphon, its new discovery at Wheeler River, is a joint venture (JV) with Cameco. That suggests additional catalysts through the winter drilling months. Denison owns a portion of the McClean Lake Mill, and the startup of toll milling at Cigar Lake should add minor cash flow. In summary, Denison's large, high-grade projects and access to the McClean Lake mill make the company a potential takeover target.

TER: The Gryphon Zone looks very promising. What is the significance of that discovery for Denison Mines?

DT: The Gryphon discovery is important for Denison, and helped buoy its stock earlier this year. Gryphon has reinforced the perception that Denison's Wheeler JV with Cameco is a world-class project, and holds potential beyond the spectacular Phoenix deposit. Recent drilling helps add physical dimensions to this important discovery. It now measures about 350 meters (350m) long and about 60m wide. Downhole gamma probe results add to evidence of the existence of several stacked and parallel uranium zones. Assays confirm previously announced probe grades, but in many cases the assays come in significantly higher. Gryphon could be one of the better discoveries from the Athabasca Basin in recent years. It's near mill infrastructure, it's on the haul road between McArthur Mine and Key Lake Mill, it's near some of Cameco's most interesting exploration projects, it's in basement rocks, which are preferred, and it could provide even more critical mass to the Phoenix deposit.

TER: "One of the better discoveries in the Athabasca"â€"that's high praise given what I've heard about the basin.

DT: It certainly is. There has been a rash of discoveries in the basement in the past several years. In the past, not much attention was paid to the basement rocks, and basement rocks are more competent. They're easier to work with, especially when they're shallower. Unconformity deposits, hands down, are the highest-grade deposits, but it's easier to work with basement deposits. Exploration for basement deposits has not been as prevalent, especially outside the Athabasca Basin, on the fringes beyond the limits of the sandstone. You wouldn't find an unconformity deposit where the sandstone has eroded away, but you can find basement deposits in those areas, and that's what we're seeing at Patterson Lake South (PLS) and the Arrow discovery. It's part and parcel of the evolving exploration methodology that people use to test the basement with these days.

TER: Do you have other top picks in the exploration and production space?

DT: These largely depend on clients' needs, and how they wish to play the sector. We see three main categories of investors. Some like to see the high risk/reward ratio of the high-grade Athabasca Basin exploration. This investment doesn't depend as much on current uranium prices, as timelines are well off in the future. Investors are more interested in how big these deposits might get. Denison and Fission Uranium Corp. (FCU:TSX.V) fall into this category.

Second, investors might be interested in a couple of U.S. ISR producers in the sweet spot of the development cycle. The exploration, development, permitting and financing of their new mines are complete, and they're in the process of ramping up initial production. Ur-Energy started up last year, and Uranerz Energy Corp. (URZ:TSX; URZ:NYSE.MKT) started up recently. Companies like these are, hopefully, going to provide increasing cash flow. That's useful for investors.

"The spot market is tighter due to a decrease in spot supply."

Finally, investors with a view that uranium prices will rise may wish to get into the names that might be challenged at lower uranium prices, or companies preparing for that inevitable uranium price rise by responsibly advancing their portfolios of projects without spending too much money right now. This might include companies like Paladin Energy, Energy Fuels Inc. (EFR:TSX; EFRFF:OTCQX; UUUU:NYSE.MKT) and Uranium Energy.

I'll start with the Athabasca explorers: Our top pick is Fission Uranium. We recommend Fission with a Buy rating, speculative risk, and a $2.10/share target price. The PLS deposit is a potentially world-class discovery. It's shallow, high-grade, continuous, remains open in essentially all directions, and it's a basement-hosted deposit. We believe the project hosts about 80 Mlb at about 1.6% U3O8, but with increased cutoff grades, its average grade rises dramatically without shedding that many pounds. At less than a buck per share trading, Fission seems like a no-brainer. The stock hasn't been at this level since August 2013, and the company's added perhaps 40 Mlb to its deposits since then. Fission's also started contemplating mining scenarios. It significantly derisked the project, plus all 61 of its summer drill holes were successful at PLS. The company cannot miss. It's likely that many investors are waiting for an initial resource, which is due by year-end 2014.

TER: What about ISR producers?

DT: As far as the U.S. ISR startups go, we recommend Ur-Energy with a Buy rating, high risk, with a $1.80/share target price. Production at Lost Creek in Wyoming has gone well in year one. Wellfields are performing nicely at the lower end of our cost curve at $20/lb. Due to current uranium prices, production was tapered back to accommodate selling exclusively into long-term contracts. Thus the operation is largely insensitive to price movements, as the company sells its uranium for more than $60/lb. Management is pretty excited about its Shirley Basin project. This is a recent acquisition from AREVA SA (AREVA:EPA) that should have even higher grades and better properties suitable to ISR mining.

We also recommend Uranerz Energy. We have a Neutral rating on the stock, high risk, and a $1.50/share target price. The stock has come off fairly strong recently. The company has long-term contracts that help cushion the impact of lower spot prices. Uranerz recently completed its first sale of uranium in the $50â€"60/lb range, by our estimate. Only about 200,000â€"300,000 lb (200â€"300 Klb) of production is hedged into contracts, suggesting that Uranerz might either slow its ramp-up or stockpile uranium in the hopes of higher prices down the road. This stock remains a favorite in the space, especially for some U.S. investors.

TER: What about your third category?

DT: In a rising uranium price environment, I suggest a few producers: Paladin Energy, Energy Fuels and Uranium Energy.

For Paladin we have a Buy rating, high risk, with a $0.60/share price target. This company is doing many things right. It continues to decrease costs, produce above mine design capacity, and improve its balance sheet, although there are a few risks still. The company recently sold 25% of Langer Heinrich Mine for $190 million ($190M). Most production was sold into contracts, but that portion was sold into the spot market. Kayelekera, which also sold in the spot market, is on the shelf until higher uranium prices return. This company has great leverage to rising uranium prices, and has been a top performing producer for the past three months.

Energy Fuels has a Buy rating, high risk, with a $14/share target. Operations feed into its White Mesa Mill in Utah, which is the only fully licensed and operational U.S. uranium mill, and it's licensed for 8 Mlb of production per year. Energy Fuels is essentially 100% hedged, with sales of 800 Klb this year, opting only to sell into contracts. Most recently, sales were almost double those of spot prices. The company has some excellent contracts. Several operations remain on standby, or construction has been halted. Higher prices are required to unlock its vast pipeline, which includes projects in Wyoming and New Mexico, plus existing mines in Colorado, Utah and Arizona, which could lead to more than 4â€"5 Mlb of production company-wide. That would provide great leverage for this company.

On Uranium Energy, we've got a Buy rating, high risk, with a $2/share target price. While Uranium Energy is officially a producer, as it has some remnant ISR production, we prefer to treat it as a developer with access to a fully permitted and operational ISR plant. What's overlooked is this company's growth opportunity, with its Anderson project in Arizona and Burke Hollow and Goliad ISR projects in Texas. The company never overpays for acquisitions and is quite active from an acquisition standpoint. It has tremendous leverage to rising prices, and probably the best growth profile of the U.S. ISR producers. We do expect Uranium Energy to play catch-up as uranium prices rise.

TER: The share price trend for Uranium Energy has been consistently down for almost three years. Is that a cause for concern or an opportunity for an investor?

DT: I think that's an opportunity. Uranium Energy is entirely unhedged. This is a company that doesn't want to enter into long-term contracts, that believes uranium prices are going to rise in the future and wants full exposure to those rising prices. It worked last time around.

In 2010, Uranium Energy was the darling of the sector. The stock was a ten-bagger that year. It went from $0.50/share to $5/share as uranium prices rose dramatically. That was a volatile stock going up, and post-Fukushima it's been a volatile stock coming down. This company will become exciting when Goliad, Burke Hollow, better wellfields at Palangana and Salvo come online. They'll give it a tremendous growth profile going forward.

TER: Uranium prices are stagnant, but some exploration stocks are doing very well. That seems counterintuitive. Are these two indicators connected anymore?

DT: There are two main issues here: timeline to production and uranium pricing. Some companies have time on their side. Long-term explorers, like Fission Uranium and Denison Mines, are in the limelight due to potentially large high-grade discoveries. High grades are sexy no matter the commodity, but 1% uranium ore at current low prices is still almost $1,000/ton rock. Investors tend to be focused on discoveries, how big they might get, what the grades are, how they will impact economics, and what those economics might be. The projects are likely to be developed well off in the future, when uranium prices are expected to be higher. At least theoretically, these companies should be partially insensitive to short-term uranium fluctuations. Other companies do trade on uranium price movementsâ€"near-term developers that require financing and producersâ€"although some mining companies should be more immune because they have the ability to sell their production into higher-priced contracts.

We've tracked investor sentiment in the sector for more than eight years now, using Uranium Participation Corp. (U:TSX) as a tool, comparing its share price with the underlying net asset value (NAV). We do recommend Uranium Participation: It's Buy rated, high risk, with a $5.70/share target price, and is a great way for investors to get into a larger, liquid company that acts as a holding company for physical uranium. We see it as leaving the production risk, the permitting risk, the jurisdictional risks, and just buying the commodity.

Lately, however, this company's usefulness as a tool has diminished because it has traded at about a 20% premium for most of this year, suggesting huge positive sentiment in the uranium equity marketâ€"although the stocks don't necessarily reflect that. Now, between the recent uranium price rally and Uranium Participation being off slightly, essentially the stock is trading at par with its NAV. This is the first time since late 2013 that the stock has been down at these levels. I think it's simply a matter of time before the stock corrects to the upside. I don't think it indicates that investors believe uranium prices aren't going to rise over the long term.

TER: Great. Thank you for your time, David.

Want to read more Energy Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

DISCLOSURE:

1) Tom Armistead conducted this interview for Streetwise Reports LLC, publisher of The Gold Report, The Energy Report, The Life Sciences Report and The Mining Report, and provides services to Streetwise Reports as an independent contractor. He owns, or his family owns, shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of Streetwise Reports: Energy Fuels Inc., Fission Uranium Corp., Ur-Energy Inc., Uranerz Energy Corp. The companies mentioned in this interview were not involved in any aspect of the interview preparation or post-interview editing so the expert could speak independently about the sector. Streetwise Reports does not accept stock in exchange for its services.

3) David Talbot: I own, or my family owns, shares of the following companies mentioned in this interview: Fission Uranium Corp. My company has a financial relationship with the following companies mentioned in this interview: Dundee Capital Markets and its affiliates, in the aggregate, beneficially own 1% or more of a class of equity securities issued by Energy Fuels Inc. Dundee Capital Markets has provided investment banking services to companies mentioned in this interview in the past 12 months: Denison Mines Corp., Fission Uranium Corp., Energy Fuels Inc. and Uranium Energy Corp. All disclosures and disclaimers are available at www.dundeecapitalmarkets.com. Please refer to formal published research reports for all disclosures and disclaimers pertaining to companies under coverage and Dundee Capital Markets. The policy of Dundee Capital Markets with respect to research reports is available at www.dundeecapitalmarkets.com. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts' statements without their consent.

5) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

( Companies Mentioned: CCO:TSX; CCJ:NYSE, DML:TSX; DNN:NYSE.MKT, EFR:TSX; EFRFF:OTCQX; UUUU:NYSE.MKT, FCU:TSX.V, PDN:TSX; PDN:ASX, URE:TSX; URG:NYSE.MKT, URZ:TSX; URZ:NYSE.MKT, UEC:NYSE.MKT, U:TSX, )

No comments:

Post a Comment