By James Bushnell and Severin Borenstein

Today we take a break from our regularly scheduled blogging about environmental topics to provide a brief message concerning electricity restructuring. Severin Borenstein and I are finishing up a draft paper for the Annual Review of Economics (available as a working paper here) that looks back over the last 20 years of electricity restructuring and it has given us a chance to update some data sets and revisit some topics that really haven’t gotten a lot of attention since around 2008.

Around that time I started giving a talk titled “If electricity restructuring is so great, why does everybody hate it?†Back then, several states like Illinois and Maryland were actively pursuing options to “re-regulate†markets that they had at least partially restructured. The New York Times ran a series of articles that pointed to studies showing that rates had increased more rapidly in states that had restructured compared to those that did not.  The gist of my talk was that this could very well be true, but did not necessarily signal that restructuring was a failure.

Back in 2000, Severin and I had written a paper arguing that the motivations for restructuring were driven more by a desire by some groups to avoid paying for stranded assets (like nuclear and coal plants which looked like white elephants in the late 1990s) than by a belief that restructuring would reap massive efficiency gains. In economic terms, customers preferred to pay market-based prices â€" which were based upon marginal cost in competitive markets â€" rather than regulated rates â€" which were based upon average production costs. During this period of relatively large capacity margins and low natural gas prices, market-based pricing appealed to customers and terrified utility shareholders whose assets would become stranded absent other compensation. However, despite the allure of market-based pricing,  the regulatory and political process allowed utilities to recover the bulk of what appeared at the time to be stranded costs. So customers ended up paying for most of these costs anyway.

The great irony of this period is that a half decade after transition arrangements largely compensated utilities for the losses incurred in selling or transferring these assets, the market value of those same assets had fully recovered. By the mid-2000s the relationship between average and marginal cost had largely reversed, and states like Illinois and Maryland expressed a great deal of regret about the decision to restructure. However, since the formerly regulated generation assets were now largely held by private, deregulated firms, there was no clear path to dramatically “re-regulate†the industry without paying full market value for those assets. Looked at this way, one can view the disappointment with restructuring as being driven by magnificently poor market timing. Utilities sold off their assets at the nadir of their value, and as natural gas prices climbed throughout the 2000s, those assets became quite valuable under market-based pricing. Therefore, my take on this topic circa 2008 was that, with hindsight certain states would have been better off restructuring, but that was due to external shocks like natural gas price increases and changes in technologies.

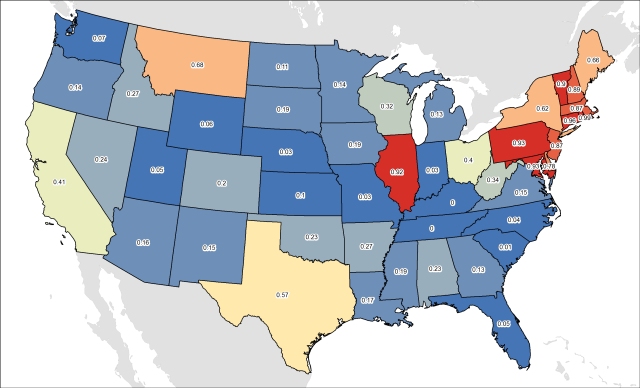

States by Percentage of Generation from IPP sources

States by Percentage of Generation from IPP sources

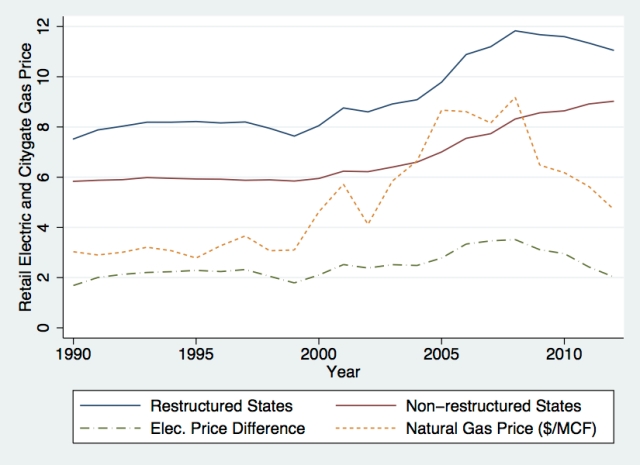

Then a funny thing happened. Since 2009, this story has largely reversed yet again. Natural gas prices have declined sharply, nearly to the levels seen at the dawn of the restructuring movement. The attention of policymakers has now been consumed by environmental priorities, particularly the implications of coal generation decline and renewable generation growth for costs and greenhouse gas emissions. A surge of subsidized renewable generation, combined with low natural gas prices, has driven wholesale prices steadily lower. As one would expect, in the short run this has benefited consumers in market-based states disproportionately more than those in regulated states. This figure plots the average prices of electricity and natural gas in “restructured†states (defined as a state with more than 40% of its energy produced from IPP sources â€" the states that are not blue in the figure above) and “regulated†states. The dashed line shows the difference between the two groups. One can see the gap between the states growing as natural gas prices climb, and then following the natural gas prices right down again.

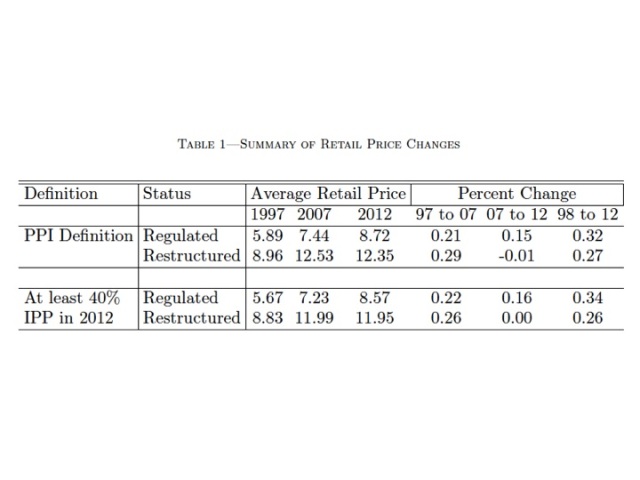

The table below summarizes the changes in rates using two different definitions of restructured that are explained in the paper. All together if you look at the changes in between the two groups now, restructured states actually come out a little better than the regulated states. Rates kept rising at a consistent trend in regulated states, while they have declined slightly in the restructured ones.

This is not meant to be a comprehensive study of rate differences.  For example, we suspect that Renewable Portfolio Standards requirements in some states, like California, are keeping rates from declining faster.  But I do find it fascinating that the situation has reversed so dramatically over the last 5 or 6 years.  Not surprisingly, there isn’t much clamoring for re-regulation these days.

This is not meant to be a comprehensive study of rate differences.  For example, we suspect that Renewable Portfolio Standards requirements in some states, like California, are keeping rates from declining faster.  But I do find it fascinating that the situation has reversed so dramatically over the last 5 or 6 years.  Not surprisingly, there isn’t much clamoring for re-regulation these days.

You also don’t see much clamoring for more restructuring either, however, which is equally interesting. The relationship between average costs and marginal costs appears again to be turning in favor of marginal costs, but today the resulting pressure is being manifested in the arena of distributed generation, rather than retail choice. Although rooftop solar and retail competition are not usually equated, from a consumer perspective the economics of each can be very similar.  Both have been pushed forward in large part by a desire to avoid paying for sunk costs â€" generation in the case of retail competition and distribution costs in the case of distributed generation.

However, looked at from a societal perspective, such motivations can be disheartening. Consider the prospect, hinted at in this article, of a future where homes install batteries and distributed generation in order to avoid paying for fixed distribution charges.  Even if this becomes economically viable from a household perspective, this is a potentially appalling waste of resources.  We would be talking about thousands of dollars of investment per household to avoid paying for assets that are already there.  Who pays for these wires? Either utility shareholders or those households that don’t leave the grid.

There are real and important technological and efficiency advances happening, and competition is providing some of the impetus for that. But much of the economics and politics of this industry have been and still are dominated by the not-very-noble desire to stick someone else with existing infrastructure costs.

Authored by:

James Bushnell

James Bushnell is an Associate Professor of Economics at the University of California at Davis. He received his BS from the University of Wisconsin in 1989 and PhD in Industrial Engineering and Operations Research from UC Berkeley in 1993. His research focuses on industrial organization and regulation, energy economics and policy, environmental economics, and game theorization optimization ...

No comments:

Post a Comment