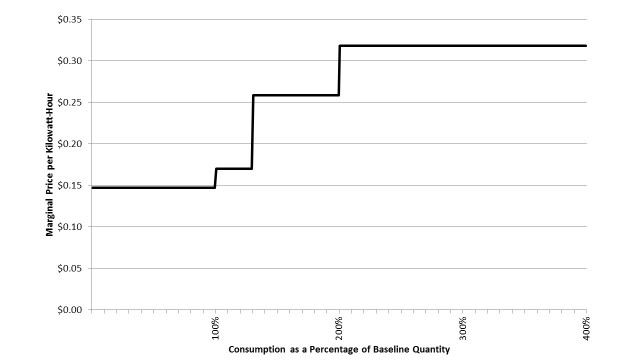

California is finally talking seriously about changing the way utilities price electricity for residential customers. In particular, as a result of recent legislative actions, the CPUC now has some flexibility to modify the extreme increasing-block pricing (IBP) schedules that were adopted after California’s 2000-01 electricity crisis.  IBP means charging more for additional kilowatt-hours as a household consumes more over the billing period. Pacific Gas & Electric’s current residential rate schedule, shown in the figure below, illustrates how IBP can charge drastically different prices for an additional kilowatt-hour (kWh) depending on how much the customer is consuming. (The rates of Southern California Edison and San Diego Gas & Electric look pretty similar.)

PG&E’s current increasing-block residential electricity rate structure

This extreme form of IBP violates one of the basic tenets of utility price setting: cost causation. Prices should reflect the cost of serving a customer. The cost of providing electricity does vary over time, an issue that I will return to below, but it does not vary with how much a household uses over the billing period. That kilowatt-hour (kWh) for which PG&E charges one customer $0.32 costs the utility the same to provide as a kWh for which PG&E charges another (or the same) customer $0.15.

The implementation of IBP in California is both unfair and inefficient, a holdover from policy made during the darkest days of the electricity crisis without careful analysis of the impact. While California’s IBP schedules are more extreme than in other states, the lessons from the Left Coast have much to teach in other locations as well.

To remind the young or forgetful (or the less-obsessed with electricity tariff history), prior to the electricity crisis, the regulated electric utilities in California had two-tier IBP rates with the second tier 15%-20% higher than the first tier. The majority of customers consumed more than their first-tier baseline quantity for their region, paying the first-tier price up to the baseline and the second-tier price for any additional electricity beyond that. But more than a third of customers only experienced first-tier rates.

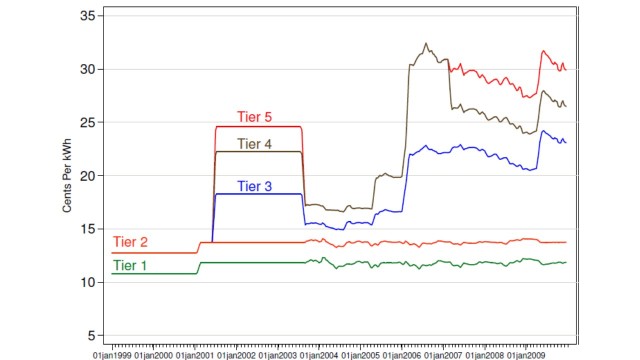

After the crisis, utilities needed to raise revenues, but politicians said they wanted to protect the poor, so regulators instituted a 5-tier system, with rates on the first two tiers â€" designed to go up to 130% of baseline quantity, which is about the median household’s consumption â€" frozen at pre-crisis levels. As a result, any revenue increase had to come on tiers 3, 4, and 5, which constituted only about one-third of the residential electricity sold. (Tiers 4 and 5 were merged into one tier a couple of years ago.) To get the needed revenue, the price on those high-tier kWhs had to go up a lot.

Southern California Edison’s tiered rates from 1999 to 2009 (Source Ito (2014))

That is how we got to the IBP schedules we have today where the highest-tier rates are more than twice as high as the low-tier rates (though the high tiers change frequently, so the exact ratio is a moving target).  This ratio is far out of line with other retail rate structures. The majority of utilities in the U.S. don’t have IBP; they sell all electricity to residential customers at the same cost per kWh. In the one-third or so that do have IBP, the rate structure typically looks more like pre-crisis California, with two tiers and only a small difference between them.

Lots of claims get lobbed into the political heat of the discussion about IBP, generally with little empirical basis, so it is worth reviewing the best evidence we have. Increasing-block pricing proponents make three cases for IBP:

First, some proponents argue that high-usage customers are more expensive to serve on a per-kWh basis because they on average consume a higher share of their electricity at peak times. It is ironic that some of the same organizations that make this argument also are the adamant foes of time-varying pricing that would reflect time-varying costs directly. In any case, my own research (published in Review of Industrial Organization in 2013) shows that there is a tiny bit of truth to this claim, but the operative word is tiny. That study shows that for PG&E and Southern California Edison, the different time-patterns of consumption between large and small residential consumers could justify at most about a few percent price difference. That would be less than a one cent per kWh average price differential, far smaller than would result even if we returned to the pre-crisis IBP structure, and vanishingly small compared to what we have today.

My study shows that the true incremental cost per kWh of serving large and small residential customers is virtually the same. And that cost is much lower than the upper-tier prices under the IBP used by the California regulated utilities. Even if you added the carbon cost of the emissions and priced those emissions at $37/ton (the latest estimate of the social cost of greenhouse gas emissions from the Obama administration), that would raise the appropriate price by less than two cents per kWh.

The second argument for IBP is the one that drove the political debate in 2001, that IBP is a way to raise rates while protecting the poor. Implicit in this claim is that poor people consume less electricity than rich people do, which makes intuitive sense, but at the time the legislation was rushed through during the crisis there was just a sense, not a measure of the real difference. A paper that I published in 2012 (in American Economic Journal: Economic Policy) shows that using the steep post-crisis IBP does help low-income customers relative to a flat rate, but by much less than you might think. The reason is that the CARE program that is explicitly designed to give lower rates to low-income consumers â€" those up to 200% of poverty or $47,700/year for a family of 4 â€" has already taken most of the low-income customers out of the standard IBP tariff and put them on a separate low-income tariff.

Overall, I estimate that moving to a flat-rate tariff would raise the average bill of a customer making about $50,000/year or less (in today’s dollars) by about $5/month. That’s not nothing, but it’s also not a huge effect to get in exchange for an increasing-block rate structure that greatly distorts prices away from real costs â€" which are essentially the same for the low-tier and high-tier kWh. Furthermore, moving from IBP to a flat rate would likely incent more truly needy households to sign up for CARE. If the goal is to help the poor, a program targeted directly at the poor makes more sense than one targeted at consumption level, which has a weak correlation with how wealthy a household is.

Using IBP to help low-income households has another problem. It arbitrarily harms many low-income households that are heavy users for completely understandable reasons. Household baselines are based on climate regions (PG&E has 10 regions, SCE has 6) and…well…nothing else. They don’t adjust for how many people live in the house, how old those people are, how much time they spend at home (rather than using electricity somewhere else), or any other reason that we would expect even an energy-conscious household to consume more. Instead, IBP rewards people who live alone and don’t spend much time at home. Does that make sense?

The third case made for IBP is that it leads to conservation, because it raises the price of marginal consumption. In theory, this could be right, but in practice it doesn’t work out that way. The idea is that it raises price for the heavier uses and lowers price for the lighter users, compared to a single flat rate, but the response of heavy users is proportionately larger.

But path-breaking research that our former grad student Koichiro Ito published this year in the economics profession’s top journal (American Economic Review) shows that most customers don’t pay attention to the marginal price they face, but instead respond to the average price or total bill. This isn’t surprising given that the vast majority of customers don’t even know we have tiered pricing and even for the electricity-obsessed it’s very hard to know what marginal price you will face at the end of the month. Ito demonstrates that when customers respond to average price, IBP results in virtually no change in total consumption.[1]

Residential Solar PV has been a big beneficiary of increasing-block pricing  (Source:http://256.com/solar/images/)

But what has become apparent in the last few years is that one small set of customers is very aware of IBP and the high marginal prices for heavy consumers: solar PV households, or actually the solar PV vendors who explain IBP to them. While evidence that IBP incents energy efficiency is absent, the evidence is clear that IBP is a key driver behind the distributed solar PV movement in California.

In fact, solar PV installers “work with†customers to optimally design systems so they just shave off the high-tier usage without touching the low-tier usage where the price is way too low for PV to save customers money. With federal subsidies that pay nearly half the cost of PV â€" and net metering that pays the residential customer for electricity supplied to the grid at the retail rate rather than the wholesale rate that other renewable generation sources receive â€" solar PV can beat the high-tier prices of IBP. That’s why solar PV installers are the most vocal opponents of rational rate reform that would call a kilowatt-hour a kilowatt-hour regardless of how many other kilowatt-hours you consume during the month.

So, increasing-block pricing isn’t cost based.  It is a very indirect way to lower the average bills of low-income customers, while arbitrarily harming many of them and benefitting many wealthy people who live alone or don’t spend much time at home (or own a second home). And it’s only effect on conservation is to create incentives to install solar that just skims off the highest tiers of the IBP structure, an activity that is pursued overwhelmingly by the richest households (and which raises the bills of all other ratepayers). The first step to rationalizing California’s electricity rates is to greatly reduce or eliminate increasing-block pricing.

Then we need to talk about time-varying pricing. We should be transitioning to opt-in time-varying pricing immediately and to opt-out in the near future. I’ve explained an efficient and equitable way to do this in a recent paper, but that will have to wait for another blog.

[1] Paul Chernick recently filed testimony on behalf of NRDC that mischaracterizes Ito’s finding, saying Ito claims consumers don’t respond to IBP. That’s not at all what Ito finds, as I explain here.  A study by Energy & Environmental Economics argues that in British Columbia IBP does lower total consumption. But the study looks only at whether high-consuming households consume less under IBP â€" which they do, not surprisinglyâ€"and ignores that low-consuming households consume more, because their price is lower than under a single flat rate. What matters, of course, in the change in total consumption, on which the E3 study is silent.

who you get your gas and electricity from it is all the same stuff and comes from the same place

ReplyDeletecheap electricity houston