Carbon pricing continues to spread around the world, with major schemes in Chinese provinces now in place.

For my first post this year it seems timely to review progress on implementing carbon pricing around the world. As I’ve previously noted, the spread of carbon pricing during the past decade has been remarkable. Once confined to a few small economies in northern Europe, it has become a worldwide phenomenon, with more than a dozen major carbon pricing schemes either in place or under development around the world. The major step forward in last year has been the start of five regional pricing schemes in China, although trading in these markets remains relatively illiquid. The expansion of carbon pricing in China is set to continue this year as two more trial schemes go live. A year from now, assuming current programmes run to schedule, carbon pricing will be in place in jurisdictions that together account for between a fifth and a quarter of total global CO2 emissions from energy and industrial processes.Â

Not all emissions in these jurisdictions are priced, as governments use other policy instruments to reduce emissions in particular sectors, for example surface transport in the EU.  Nevertheless, by next year over 10% of the world’s energy and industry CO2 emissions are likely to be priced.

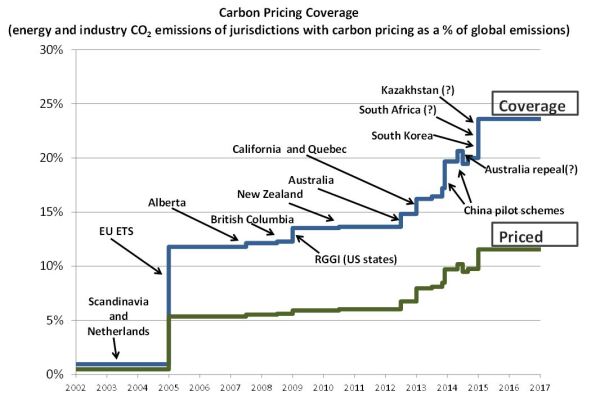

On the Chart below the top (blue) line shows how the percentage of emissions in jurisdictions with pricing has grown over the last decade. The total includes all energy and industry CO2 emissions taking place in each jurisdiction with carbon pricing.  Thus, if all jurisdictions in the world had carbon pricing in place the total coverage would be shown as 100%. The lower (green) line shows the percentage of energy and CO2 emissions that are actually priced.  For example, the EU accounts for around 11% of emissions, but only a little under half of these are priced by the EUETS. The gap between the blue and the green lines is the proportion of emissions covered by other policies, or by no policy. Even if carbon pricing were to be extended to 100% of jurisdictions it is likely that some emissions would remain unpriced.Â

CO2 emissions from land use and emissions of other greenhouse gases are excluded from the calculations. Including these would reduce the proportion of emissions in jurisdictions with pricing, in part because of a large volume of emissions from deforestation in countries without national carbon pricing, notably in Brazil and Indonesia.  Nevertheless the trend is remarkable, and implies that any country considering carbon pricing is very much part of the worldwide policy mainstream.

Coverage of carbon pricing is increasing …

By far the most significant new development over the next few years is likely to be the extension of carbon pricing across all of China, which the Government has indicated it wishes to see in the next few years. This alone would raise global coverage of carbon pricing to over 40%. Indonesia is also looking at carbon pricing with a prospective voluntary market potentially leading to a compulsory market in due course.Â

We may also see somewhat more widespread carbon pricing in the USA. EPA regulation of existing power plants under the Clean Air Act will oblige states to put in place implementation plans. This may lead states to establish emissions trading schemes, or (more likely) join the Regional Greenhouse Gas Initiative (RGGI), which covers the power sector only. Indeed some states are understood to have already expressed an interest in doing so, although it is not yet clear in which states interest is strongest. Expansion of Western Climate Initiative trading schemes beyond California and Quebec also remains possible.

There also appears to be a trend towards carbon pricing in Latin America. Mexico may strengthen its currently very limited carbon tax (excluded from the chart) over time. Provinces in Brazil have looked at emissions trading schemes, and discussions on an ETS are now underway in Chile.

Future trends are, however, far from clear, and the commitment by the Australian government to repeal its carbon pricing legislation is an indication that consistent progress is far from guaranteed.

For those involved with carbon pricing day-to-day it is often easy to forget just how recent it is, and just how much progress has been made in a short time. There is still only a single decade of experience, compared with many decades, and in some cases centuries, for other types of regulation. As a regulatory “technology†large scale carbon pricing remains more recent than the ipod, and there is still much to learn and a long way to go. But the achievement to date is both substantial and encouraging.

Notes on inclusion and exclusion from the chart:   The small carbon tax introduced in Japan in 2012 by modifying energy taxes is excluded, as is the carbon tax in Mexico, which is small and has limited scope.  The Tokyo emissions trading scheme is excluded as its current status is unclear.  The Swiss scheme is included in the total for the EU.  The status of the Kazakhstan scheme is currently uncertain and I have allowed for a year’s delay to 2015. For simplicity the California and Quebec schemes are shown with full coverage from their introduction in 2013, although they do not reach this in practice until next year. Question marks indicate measures which have yet to be enacted.Â

Comparison with World Bank study: The results here are similar to those from a World Bank Study of carbon pricing from 2013, but on a slightly different basis. The World Bank study quotes just over 10Gt out of 50Gt of emissions taking place in jurisdictions with pricing.  This is for all GHGs.  The total shown here is around 8Gt out of 34Gt (2012 data) for carbon dioxide emissions from energy and industry.  The main difference in the total Gt of emissions in jurisdictions with pricing appears to be due to the inclusion in the World Bank study of a number of jurisdictions where pricing is at an earlier stage than shown here, notably Turkey, Ukraine and Brazil.  However South Africa is excluded from the World Bank total, as is British Columbia.  The total emissions actually priced is quoted by the World Bank as 3.3 Gt, which is 10% of carbon dioxide from energy and industry and 7% of total GHGs, but this excludes some of the China pilots for which no data was available. I have included estimates in these cases.  If the other pilot Chinese schemes were included  in the World Bank totals their estimates of coverage would likely increase by about a percentage point (to 11% of energy and industry and 8% of total GHGs), roughly in line with the totals quoted here.  The World Bank study can be found at http://documents.worldbank.org/curated/en/2013/05/17751166/mapping-carbon-pricing-initiatives-developments-prospects.

Data: Emissions data is for 2012, from the EDGAR database, with no adjustment for changes in relative volumes over time. Shares at subnational level are estimated based on a range of data. Data sources include  http://edgar.jrc.ec.europa.eu/  and Zhao et. al., China’s CO2 emissions estimated from the bottom up: Recent trends, spatial distributions, and quantification of uncertainties Atmospheric Environment, Volume 59.

Authored by:

Adam Whitmore

Adam Whitmore has over 20 years' experience of the energy sector, and has been working on climate change issues for much of the last 15 years for companies, governments and regulatory agencies. Â He writes about all aspects of climate policy.

No comments:

Post a Comment