DENVER, Colo. â€" Colorado investors want to see development of alternative energies, but are still open to traditional energies in their portfolio, according to Morgan Stanley’s Investor Pulse Poll, conducted among high net worth investors (investable assets of $100,000 or more) in late 2014.

Colorado high net worth (HNW) investors see a place for U.S. policy in addressing the nation’s energy challenges. Most (86%) agree that the U.S. should invest in technology and programs designed to increase energy efficiency. However, they are split on how to achieve this: 43% favor expanding production of alternative energies (wind, solar and biomass); 37% favor expanding production of traditional energies such as oil, gas and coal; and 18% suggest pursuing both energy types equally. Colorado investors are supportive of both alternative and traditional energies: 75% support the expansion of wind farms, 73% support fracking of shale deposits to develop oil and gas resources, 71% support expansion of solar farms and 69% support developing the Keystone Oil Pipeline.

Similarly, Colorado HNW investors see a place for investments in both types of energies: their top prospects in the Energy sector for 2015 are natural gas (79%), petroleum-based energies (67%), solar (53%), wind (46%) and battery-powered electric vehicles (45%). Compared with HNW investors nationwide, those in Colorado are more supportive of fracking (73% vs. 53%) and are less supportive of expanding solar farms and parks (71% vs. 80%).

On average, investors estimate that 17% of their portfolio is allocated toward the Energy sector.

COLORADO INVESTORS ARE MORE SUPPORTIVE OF HYDRAULIC FRACTURING THAN INVESTORS POLLED IN OTHER MAJOR U.S. CITIES

Colorado HNW investors are more supportive of fracking than investors across the country. When asked whether they support hydraulic fracturing to develop oil and natural gas resources, 73% of HNW investors in the greater Denver area responded as supportive. This figure compares with 37% in San Francisco, 47% in Los Angeles, 46% in Boston, 43% in Chicago, 48% in New York City, 64% in Atlanta, and 71% in Houston.

RATE OF RETURN TOP CONSIDERATION WHEN INVESTING IN ENERGY SECTOR

Rate of return (investment performance) tops the list of factors Colorado HNW investors consider when deciding whether to invest in the Energy sector, cited by 93%. More than eight in 10 want to see a track record of success and growth (84%), while 76% desire diversification, 70% consider energy independence and 66% consider environmental impact.

CLIMATE CHANGE SEEN AS IMPACTING PLANET MORE SO THAN PORTFOLIO

Nearly six in 10 Colorado HNW investors (57%) say that climate change is affecting the planet and 60% say that humans are having at least some impact on climate change. When it comes to their investments, three in ten (30%) report that climate change is affecting the value of their investments/portfolio.

MOST INVESTORS PLAN TO ENGAGE IN SUSTAINABLE BEHAVIORS

Fully 95% of Colorado HNW investors plan to engage in at least one (of 12) sustainable behaviors in the next three years. Relatively inexpensive options top the list of potential actions: 69% plan to conserve water, 64% hope to install more energy-saving light bulbs, 63% plan to become better at turning off lights when leaving a room, 62% plan to turn down the thermostat in the winter/turn up the thermostat in the summer, 54% hope to recycle more and 52% say they will turn to paperless billing. Still, there is interest in engaging in more expensive behaviors, as 45% anticipate replacing appliances with high-efficiency models, 38% hope to purchase a more fuel-efficient vehicle, 28% plan to install better insulation in the home and 20% hope to buy “smart†products that use less energy. Just 3%, however, anticipate installing solar panels in the near future.

The Morgan Stanley Investor Pulse Poll was conducted via telephone interviews from October 14 through December 2, 2014, by GfK Public Affairs & Corporate Communications. A total of 301 respondents in the greater Denver market were interviewed using a listed sample of landline phone numbers pre-identified as high net worth households ($100,000 or more in liquid investable assets). Respondents were required to be between the ages of 25 and 75 years old and to be one of the primary decision makers in the household for financial matters. Quotas were applied in order to obtain approximately one-third in each of the following categories: $100,000 to $499,000; $500,000 to $999,000; and $1 million or more in investable assets. Results were then weighted to age within each of these three asset classes using the Federal Government’s Survey of Consumer Finances data. The margin of error on the total sample is +/-5.6 percentage points on the total; the margin of error among subgroups is higher.

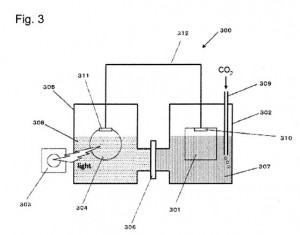

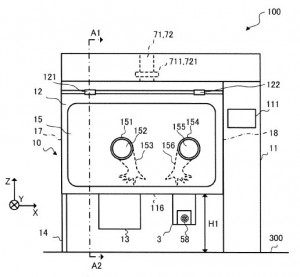

We’ll start off today’s analysis of Panasonic’s recent innovations with a look at a trio of novel technologies developed for medical fields. An improved apparatus for observing cultured cells and other microorganisms in a decontaminated environment is discussed within U.S. Patent Application No. 20140356942, filed under the title Isolator (shown left). The isolator that would be protected includes a working chamber in which a worker performs a task and a storage chamber that maintains an airtight state while in communication with the working chamber through an opening in a bottom plate of the working chamber. This isolator apparatus can be installed in a smaller space and is also configured to better protect an observation device when moving the device between the storage chamber and the working chamber.

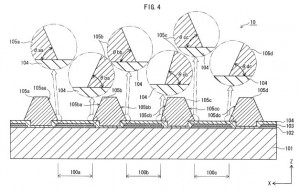

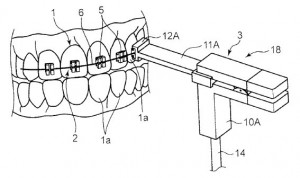

We’ll start off today’s analysis of Panasonic’s recent innovations with a look at a trio of novel technologies developed for medical fields. An improved apparatus for observing cultured cells and other microorganisms in a decontaminated environment is discussed within U.S. Patent Application No. 20140356942, filed under the title Isolator (shown left). The isolator that would be protected includes a working chamber in which a worker performs a task and a storage chamber that maintains an airtight state while in communication with the working chamber through an opening in a bottom plate of the working chamber. This isolator apparatus can be installed in a smaller space and is also configured to better protect an observation device when moving the device between the storage chamber and the working chamber. We were also intrigued by the novel orthodontic therapy and device explained within U.S. Patent Application No. 20140335467, which is titled Vibration Imparting Device for Dental Use (shown right). This technology is designed to capitalize on the discovery that vibrating forces imparted to a tooth can improve teeth alignment without the physical or physiological burdens imposed by continuous forces imparted by a bracket device. The patent application would protect a vibrating dental device for vibrating a specific tooth and teeth in a dentition to which an orthodontic device is attached; vibrations are transmitted through a contact portion which is detachably connected to the orthodontic device.

We were also intrigued by the novel orthodontic therapy and device explained within U.S. Patent Application No. 20140335467, which is titled Vibration Imparting Device for Dental Use (shown right). This technology is designed to capitalize on the discovery that vibrating forces imparted to a tooth can improve teeth alignment without the physical or physiological burdens imposed by continuous forces imparted by a bracket device. The patent application would protect a vibrating dental device for vibrating a specific tooth and teeth in a dentition to which an orthodontic device is attached; vibrations are transmitted through a contact portion which is detachably connected to the orthodontic device.